Estimate My Savings

With over $100 Million claimed in worldwide R&D Tax Credits with our accountant and consultant partnerships, SHAIN offers a full turnkey service for seamlessly claiming the R&D Tax Credit. Use your credits to offset your next Payroll Tax and AMT.

MANY INDUSTRIES QUALIFY

FOR R&D TAX CREDITS

Developing or manufacturing products? The R&D Tax credit is not just for laboratories. Any company big or small, your everyday activities can qualify! Many industries are engaged in eligible tax credit activities and SHAIN automatically creates all the documents you need to claim and support your credits.

AUTOMATE WITH

ARTIFICIAL INTELLIGENCE

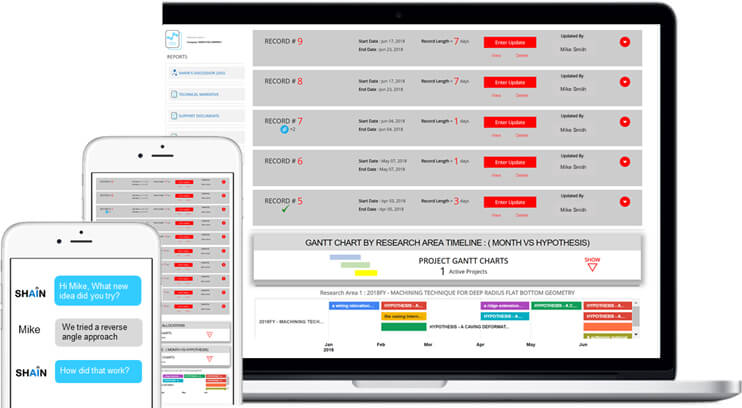

Avoid countless hours of manual paperwork and expensive onsite teams. MEET SHAIN: Step into the future and automate your R&D Tax Credit with a conversational AI interface. Say good-bye to outdated manual project tracking. No more manual report writing, or backtracking documents.

COMPLY WITH

IRS 4-PART TEST

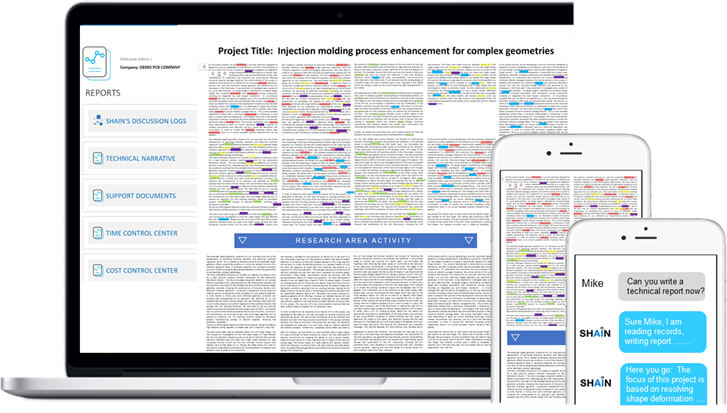

SHAIN reads your records and writes project descriptions for the IRS 4-Part Test requirements. Capture your labor, supplies and contractor activities aimed at resolving your project technical uncertainties.

Payroll Offset

AMT Offset

4 - Part Test

Food Manufacturer

Claimed over

Product Development Company

Claimed over

Electronics PCB Manufacturer

Claimed over

Machining & Tooling Shop

Claimed over

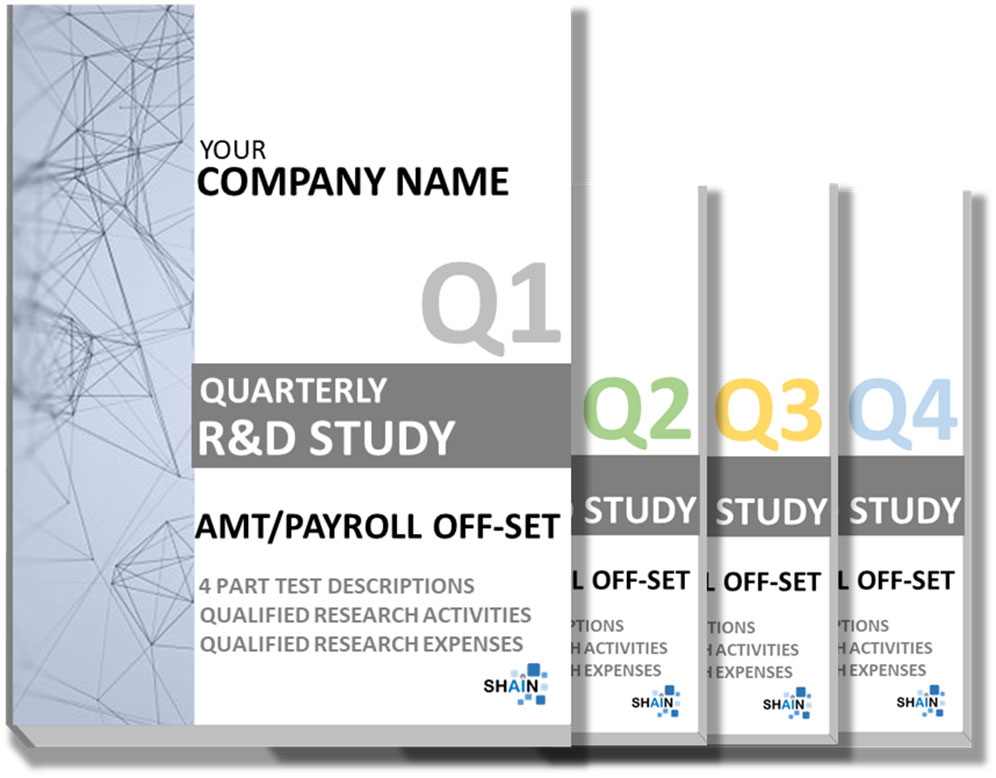

OFFSET YOUR PAYROLL & AMT

CREATE QUARTERLY R&D STUDY

SHAIN’s Quarterly report includes Qualified Research Expenses consisting of employee labor, contractors and supplies creating the nexus between your activities and expenses.

SET UP YOUR PROJECTS

WITH OUR TEAM

Apply the 4-Part Test and set up eligible projects. Our team will assist in a pre-Study of projects in your last three open tax years and projects moving forward.

SHAIN CREATES YOUR

QUARTERLY R&D STUDY

SHAIN tracks your work and automatically creates a Quarterly R&D Study to claim and support your credit. Includes technical project descriptions that explain how your work meets the 4-Part Test criteria.

CLAIM YOUR R&D

TAX CREDIT

Use the project data from SHAIN’s Quarterly report to calculate and claim your credit. Claim your AMT or Payroll offset.

…no more long interviews, no more backtracking documents, no more time survey estimations, no more writing technical narratives …Industry R&D Tax Credit Consultant

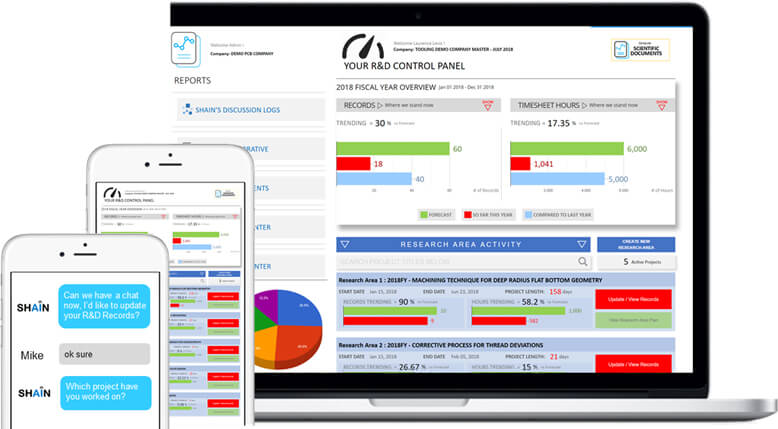

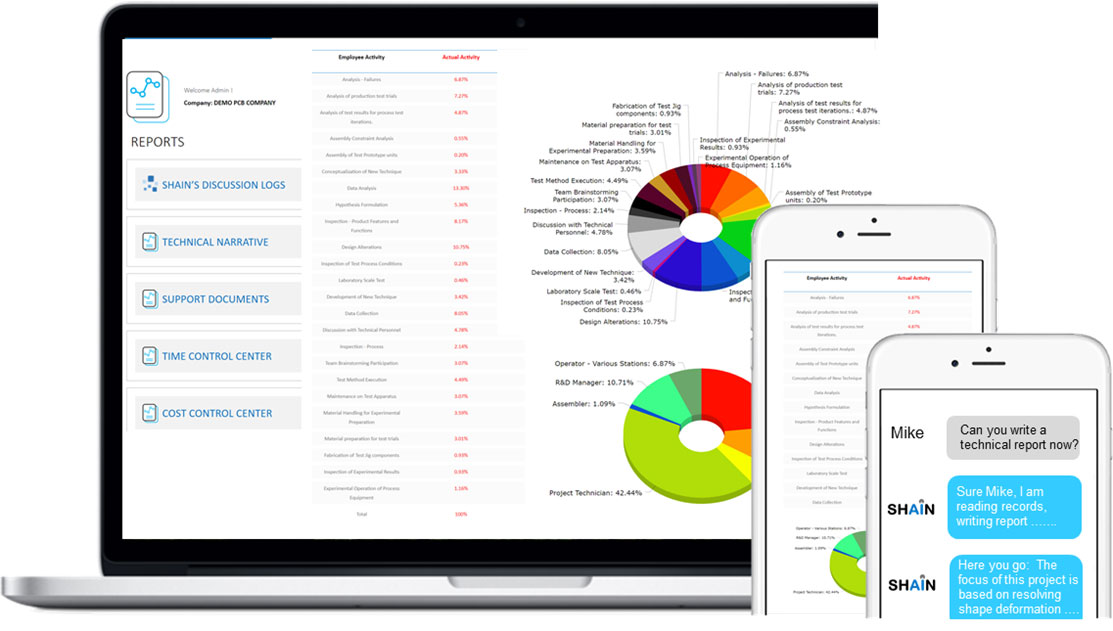

MANAGER’S

R&D STUDY CONTROL PANEL

You’re in Control. SHAIN’s R&D Control Panel provides managers with a consolidated knowledge center.

Track the progress of your R&D Ideas. Everything you need to know about your Quarter, fiscal year and project status.

TOP CALIBRE LINGUISTICS

WRITES PROJECT DESCRIPTIONS

SHAIN composes detailed drafts in real time, saving up to hundreds of hours in technical discussions and manual typing tasks.

4-PART TEST

QUALIFIED RESEARCH ACTIVITIES

TRACK

QUALIFIED RESEARCH EXPENSES

Create the nexus between your R&D team hours and related activities for eligible projects. Activities are tracked and linked to employee timesheet hours all managed by SHAIN.

Capture team hours, supplies and & contractors as part of eligible project expenses.

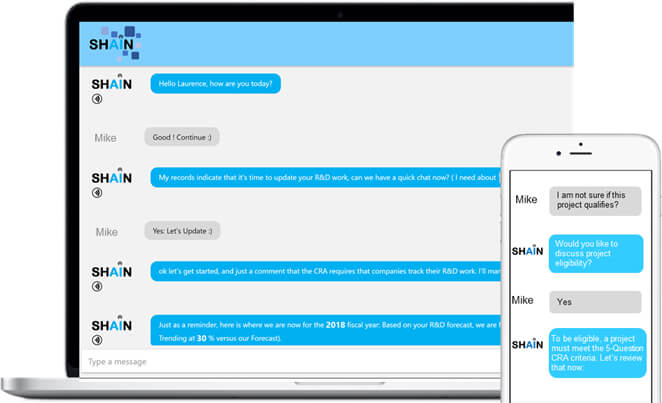

NATURAL LANGUAGE

AI PLATFORM

Email, telephone calls and physical visits are an outdated and expensive way to collect project data and conduct technical interviews.

Step into the future and engage SHAIN’s Natural Language Platform. Stay in touch with technical teams regularly throughout the year, capturing project data and reporting back to managers.

SOME MORE GREAT FEATURES

BACKED BY CONSULTANTS

Need Any Help? Our programs include customer success consultants to ensure that you are successful with your projects. Always available to support and assist you in any way.

UPLOAD YOUR DOCUMENTS

Have you own Project records, Support Documents? No problem. Upload and SHAIN will organize as part of your master support documents. Say good by to scattered documents

SHAIN’s CLOUD SECURITY

As the entire world goes to the cloud, SHAIN’s servers are protected by top industry standards consisting of SSL certificates and Anti-DDoS.Verify SHAIN’s SSL live Security Certificate status Now.

… an Oxford University study estimates that 47% of US jobs could be replaced by robots and automated technology …

Written by senior Automation Engineers, join our FREE NEWSLETTER and stay informed how Artificial intelligence is transforming businesses world wide.