With over $100 Million claimed in worldwide R&D Tax Credits with our accountant and consultant partnerships, SHAIN offers a full turnkey scientific service for seamlessly claiming the R&D Tax Credit. We achieve both IRS submission and support documentation requirements. SHAIN is your backroom AI engineer that creates a virtual R&D department and computes scientific support document studies of a company’s workflow.

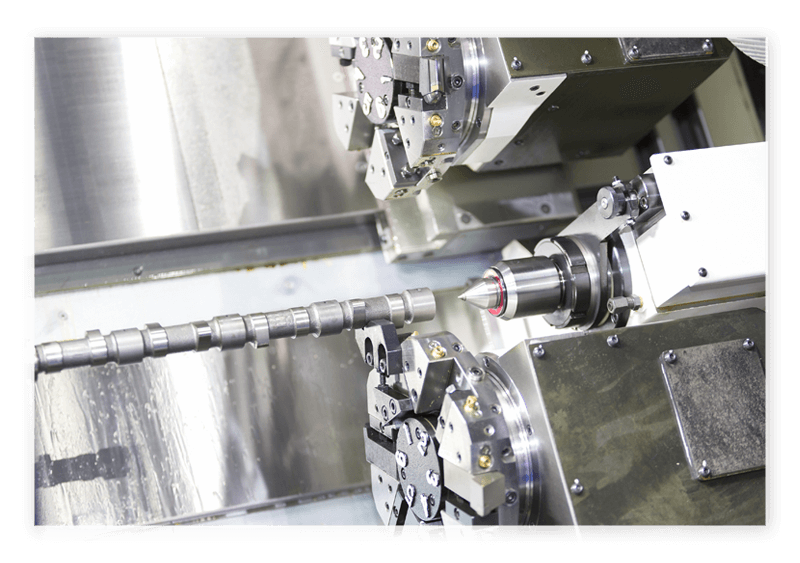

Machining & Tooling Shop

Claimed over

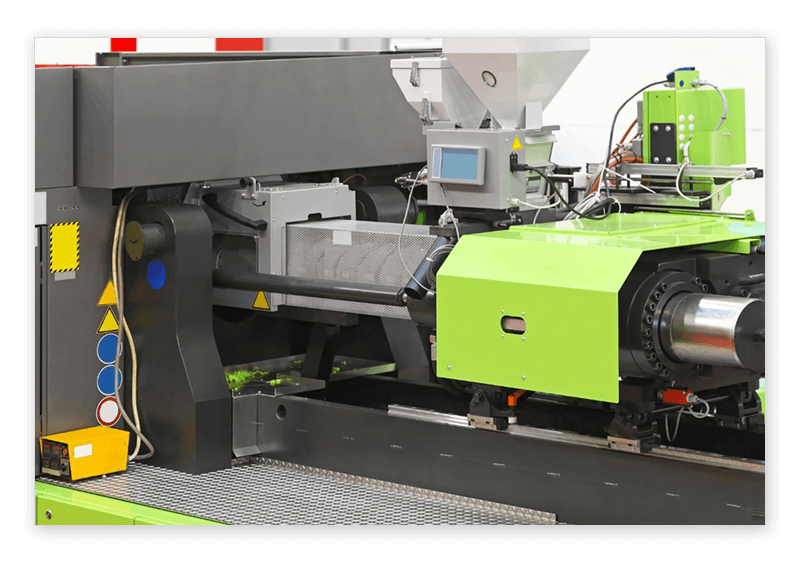

Food Manufacturer

Claimed over

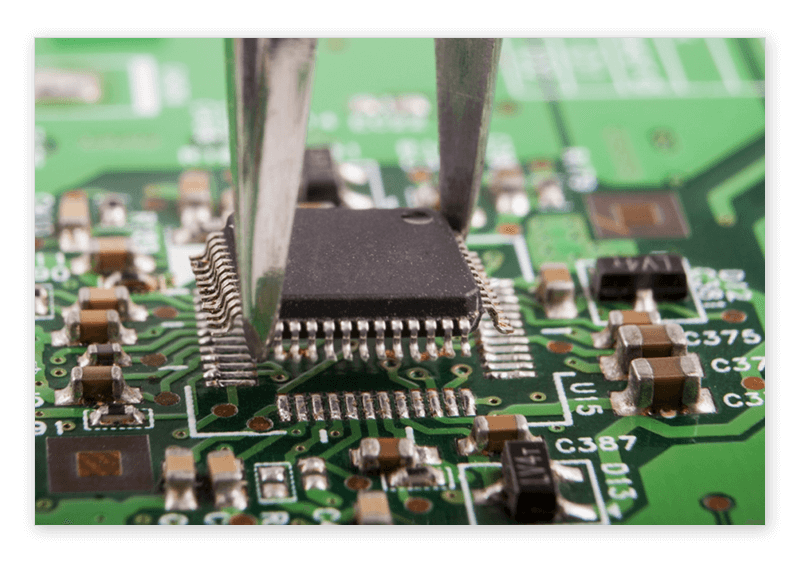

Electronics PCB Manufacturer

Claimed over

Product Development Company

Claimed over

…no more long interviews, no more backtracking documents, no more timesheet estimations, no more writing reports…Industry Research Tax Credit Consultant

The Research Tax Credit by AI

SHAIN automates the Research Tax Credit claim process and becomes the company’s backroom engineer that assists teams and computes IRS Nexus scientific support document workflow studies. Unlike traditional Tax Credit preparation methods that require countless hours, SHAIN is a Narrow AI platform that replaces time consuming workloads with intelligent automation.

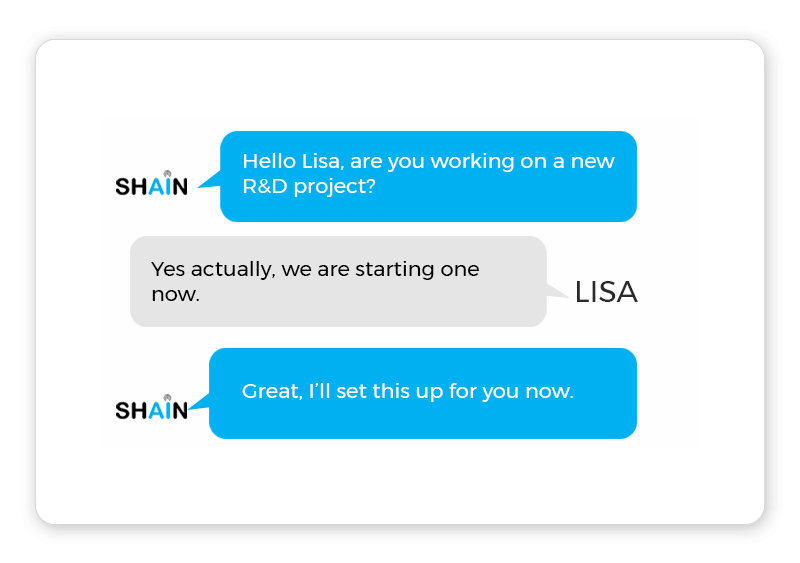

Conducts Technical Interviews

The R&D Tax Credit claim preparation by expensive and exhaustive end of year interviews and backtracking is an outdated and ineffective method of creating a defendable claim. This traditional method has been unchanged since 1986, the same year that IBM invented the personal computer. SHAIN works in real time and completes claims on the last day of the claimable fiscal year.

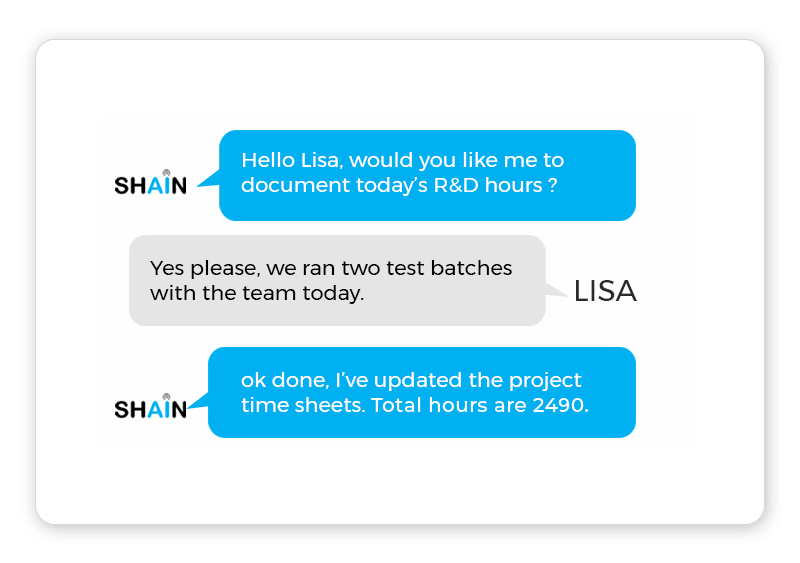

Conducts Time Surveys

SHAIN automates the Research Tax Credit process, assists teams and computes IRS Nexus scientific support document workflow studies. SHAIN’s knowledge is designed by senior engineering teams that have extensive knowledge in claiming Research Tax Credits.

The Research Tax Credit

Written by senior Automation Engineers, examine a case study of how AI disrupts the traditional highly manual and labor intensive requirements to conduct R&D, prepare and support an R&D Tax Credit claim. This FREE White Paper focuses on the opportunity that Artificial intelligence brings to companies, CPA firms, and consultants for claiming the Research Tax Credit.

Writes Technical Narratives

Unlike traditional Tax Credit preparation methods that require countless hours of interviews and audit support, SHAIN is a Narrow AI platform that is 100% non intrusive. SHAIN stays in constant contact, requires no physical meetings and assists employees at their discretion replacing time consuming workloads with intelligent automation.

… an Oxford University study estimates that 47% of US jobs could be replaced by robots and automated technology …

Written by senior Automation Engineers, join our FREE NEWSLETTER and stay informed how Artificial intelligence is transforming businesses world wide.